listening247 In the Press

Swiss Banks: What is the impact after the Credit Suisse collapse?

IMD’s Peter Nathanial and INSEAD’s Ludo Van der Heyden, examine in their article, how the fallout after the Credit Suisse collapse impacted Switzerland's image as a country. The article is based on listening247's social intelligence collected, tagged and analysed by its proprietary social listening platform.

On March 19, Swiss authorities facilitated the takeover of Credit Suisse by UBS to protect the Swiss economy, a move that surprised many despite prior assurances of Credit Suisse's liquidity. This intervention highlighted longstanding governance issues that had been inadequately addressed, raising concerns about the effectiveness of Swiss governance in managing financial stability. The takeover not only marked a sad end for Credit Suisse but also questioned the strength of governance in maintaining the Swiss Financial Centre's stability. These concerns were acknowledged in the Expert Group on Banking Stability’s 2023 report, issued by the Federal Department of Finance.

The saga continues

In early June, the Swiss Parliament announced a Parliamentary Inquiry Committee to investigate the government's and regulatory authorities' handling of the Credit Suisse crisis, marking only the fifth such inquiry in the country’s history. This investigation underscores that the crisis is far from over, highlighting the ongoing unpredictability of financial markets. Despite Credit Suisse avoiding bailouts during the 2007-08 Global Financial Crisis, its sudden collapse suggests that the Swiss Financial Centre has not fully learned the necessary lessons, particularly regarding the need for more systematic oversight. The Expert Group on Banking Stability’s 2023 report calls for increased government involvement and stronger regulatory oversight in response.

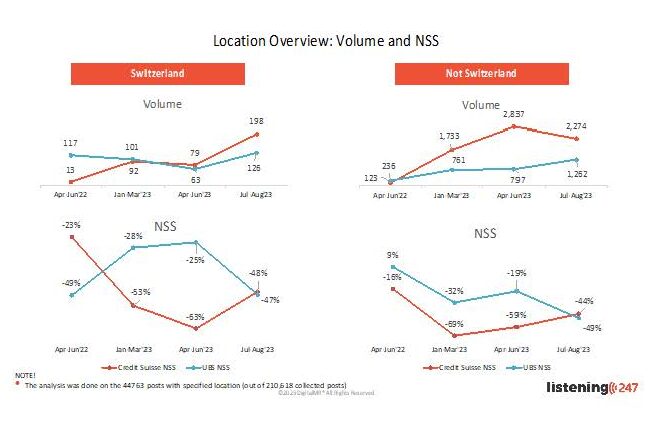

Fig 1. An analysis of stakeholder sentiment in Switzerland and around the world confirms that the Swiss Financial Centre has not benefitted from the Credit Suisse crisis, to say the least

Switzerland's decision to consolidate financial power into UBS, whose assets now equal 2.5 times the nation's GDP, heightens the "too big to fail" risk and creates significant moral hazard. This move also raises concerns about UBS's past misconduct, including involvement in tax evasion schemes and fraud, which could further jeopardize the Swiss economy and its global reputation.

Swiss authorities and citizens need reassurance that UBS will abandon its past misconduct, given the dominant position it now holds in Switzerland. This situation raises concerns about the independence and trustworthiness of Swiss authorities, questioning whether the interests of Swiss citizens were compromised in favor of UBS, especially given the lack of significant taxpayer protections and the minimal cost of the Credit Suisse takeover.

In a recent address to the Zurich Bankers Association, the new CEO of the Swiss Banking Association (SBA) acknowledged, "there is still a lot we do not know, which is why a thorough investigation into what happened at Credit Suisse is essential." The Parliamentary Inquiry Commission (PIC) will likely seek to answer these questions over the next 12-15 months. However, the pressing question remains: will the global community allow the Swiss Financial Centre (SFC) the time it needs to restore or preserve its reputation?

Swiss banking history is unfolding before our eyes, making it crucial to grasp the impact of sentiment—both in Switzerland and internationally—on the reputation of the country’s financial sector in light of the Credit Suisse events.

A hit to sentiment

To begin understanding how these events have impacted the image and goodwill towards Switzerland, the Swiss Financial Centre, and the banks involved, we have partnered with listening247, a research organization specializing in machine learning and AI. They will scan social media for unsolicited stakeholder opinions on Switzerland, using keywords like trust, stability, and competence to gauge sentiment on these themes. This type of sentiment analysis is increasingly becoming a standard tool for early problem detection and crisis management for major brands and institutions.

" Switzerland has now taken a huge risk and is doubling down on the 'too big to fail' doctrine emanating from the GFC advocates creating even more moral hazard."

Net Sentiment Scores (NSS™) for the Swiss Financial Centre (SFC) shifted from fully positive before March 19 to slightly negative afterward, indicating newfound vulnerability. While the Swiss National Bank (SNB) slightly improved its sentiment and the government saw a small decline, sentiment toward FINMA turned negative. These changes suggest emerging concerns about Swiss market authorities, an issue the Expert Group has recognized and begun addressing. Tracking sentiment moving forward will be important.

Work Ahead of UBS

Not all banks were negatively impacted by the Credit Suisse crisis. Raiffeisen gained favor, and sentiment toward Julius Baer remained steady. Most Swiss banks, apart from Credit Suisse and UBS, maintained or improved their positions, reassuring stakeholders that they were distanced from the crisis, with CS, UBS, and Swiss authorities as the main players. The NSS™ dynamics of Credit Suisse and UBS reveal some notable insights.

Unfortunately, sentiment among both Swiss and international observers is negative. The NSS™ methodology indicates this reflects a risk factor and potential vulnerability moving forward.

Swiss and international sentiments have diverged in their negativity. Credit Suisse entered the crisis with already negative ratings, which worsened but slightly improved after its absorption into UBS. In contrast, UBS, which had a negative sentiment in Switzerland before the crisis, initially saw some improvement due to its role in rescuing Credit Suisse. However, this positive sentiment faded within six months, and UBS's standing in Switzerland has returned to where it was a year ago, possibly due to its tough negotiating stance or perceived reluctance to rescue Credit Suisse.

The sentiment abroad has become as negative as in Switzerland, with UBS now fully absorbing the negative sentiment once directed at Credit Suisse. UBS faces increased risk due to its larger size and negative NSS™, a known risk predictor. The UBS CEO's recent claim that cantonal banks pose a greater systemic risk than UBS is illogical, as these banks are well-guaranteed, operate locally, and have minimal concentration risk. The NSS™ analysis also explains why deposits are flowing to cantonal banks, a trend that the Credit Suisse takeover and the CEO's remarks are unlikely to reverse, especially given the SNB Chairman's call for customer mobility in seeking competitive bank offers.

The government’s intervention in CS

The review of Swiss authorities' handling of the Credit Suisse crisis raises key questions. What was the plan behind their intervention, and why weren't more assertive actions taken earlier despite their limited powers? Interventions at the board level, such as changing the Chairman, could have been quick, yet the actions seemed timid or absent. For instance, why did Swiss authorities allow Credit Suisse to hire a CEO from the insurance sector, while the company's top leaders lacked banking expertise, and why didn’t they demand changes to CS’s business model or create a toolkit for such crises?

Fig 2. The exceptional financial concentration into UBS puts the entire Swiss economy at risk since total UBS assets now equal 2.5 times Swiss GDP

Enhancing AI-Driven Electoral Analytics

listening247 is set to further enhance its algorithmic precision and broaden its application across various demographic and linguistic landscapes. The success in the UK elections serves as a testament to the potential of AI solutions to transform electoral strategies and deepen our understanding of voter behaviours.

If interventions were so hesitant, what does this reveal about the Swiss authorities' supervisory capabilities? Was Credit Suisse in worse shape than initially reported during its government-led rescue? Why weren’t healthier segments like wealth management and Swiss retail spun off to benefit the Swiss Financial Centre and its reputation? Why are Swiss authorities permitting the concentration of financial risk in UBS, allowing it to build a monopoly while leaving taxpayers bearing the downside?

These questions cast doubt on the effectiveness of the Swiss regulatory framework. How will Swiss authorities supervise UBS, especially with concerns about the "revolving door" where former executives might oversee their previous employer? Should Switzerland consider closer cooperation with the EU’s Single Supervisory Mechanism (SSM), which has stronger supervisory capabilities? FINMA could lead by adopting transparent standards similar to those of the SSM, such as avoiding former UBS or Credit Suisse executives on its board, to prevent perceived bias and enhance its supervisory role. Additionally, Swiss authorities should consider rebranding and empowering their agencies to better oversee financial institutions.

The world wants answers

A key issue remains the ongoing uncertainty surrounding Credit Suisse, Swiss banking, and the Swiss Financial Centre, which will likely persist until the Parliamentary Inquiry Committee’s evaluation in about 12 months. The lack of a clear plan delays the restoration of Switzerland’s brand and image. This situation parallels the UK's Brexit, which stemmed from unresolved economic model debates post-GFC. The lack of a strategic discussion on the UK’s future led to Brexit as a superficial solution, highlighting the need for proactive national governance and long-term planning, which was missing after the 2008/09 crisis.

Fig 3. Evolution of Net Sentiment Scoring of CS and UBS over the period April 2022 – August 2023, with information on the volume of items identified in the search

The critical question is why key issues in the Credit Suisse crisis were not addressed sooner or were answered unexpectedly. If progress is being made, the direction needs clarity; if not, it’s better to acknowledge this early and discuss new strategies. The PIC report, while taking over a year, may be seen as overly bureaucratic in the fast-paced global financial world, suggesting a lack of urgency. The Expert Group on Banking Stability 2023 contradicts the notion that everything is under control, and both Swiss and international stakeholders expect prompt action. Switzerland’s traditionally slow and cautious approach may not align with the rapid pace of today’s world, highlighting the risk of underestimating global sentiment and the need for immediate measures.

Conclusion

Our analysis confirms that the Swiss Financial Centre has not benefitted from the Credit Suisse crisis, and this situation requires ongoing monitoring. UBS, despite its financial gain and near-monopolistic position in Switzerland, fares poorly in sentiment analysis. Previously, both UBS and Credit Suisse offered unique banking services under Swiss bank secrecy to international clients. Without this secrecy, UBS's competitiveness now hinges on providing superior banking services, supported by a skilled workforce and a stable legal and political environment, with Switzerland managing 25% of cross-border assets according to the Swiss government.

The Swiss Financial Centre faces two major governance challenges: can FINMA recover from its perceived inaction during the Credit Suisse crisis, and how will it demonstrate improved capability to anticipate and intervene in future crises? Failure to address these issues effectively could have severe consequences for Switzerland and the global financial system.

Origal Source: IMD