listening247 In the Press

listening247 finds link between bank stock price and ESG buzz

London, July 12th 2019: As part of a syndicated social intelligence report, listening247 harvested 4.5 million online posts about 11 major banks from Twitter, News, Blogs, Forums, Reviews and Videos. All relevant posts were annotated with topics and sentiment using custom machine learning models.

The daily stock price of the banks involved was then regressed against various time series of variables from the annotated posts.

Here are some specific examples of correlation between ESG posts and bank valuations:

Deutsche Bank

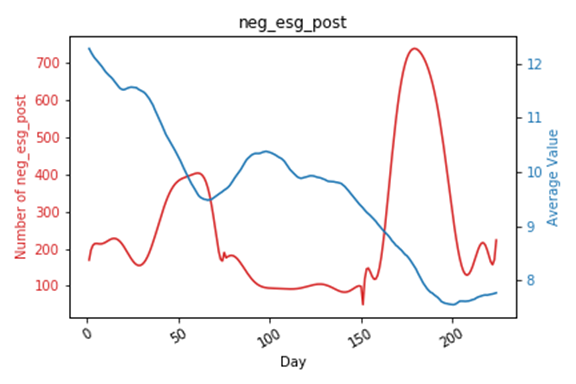

Fig 1. Deutsche Bank - correlation between ESG posts and bank valuations

Negative posts about ESG from all online sources were correlated against the DB stock price using a 30 day rolling average. The result was negative correlation as one would expect R2 = -0.40.

Societe Generale

Looking at posts about ESG coming from news only i.e. editorial content, regardless of sentiment, the correlation factor of monthly total posts and monthly valuation was R2 = 0.79.

Royal Bank of Scotland

For RBS the correlation factor was even higher when using News posts with positive and neutral sentiment, at R2 = 0.87. In this case the 30 day rolling average was used for both variables.

Barclays

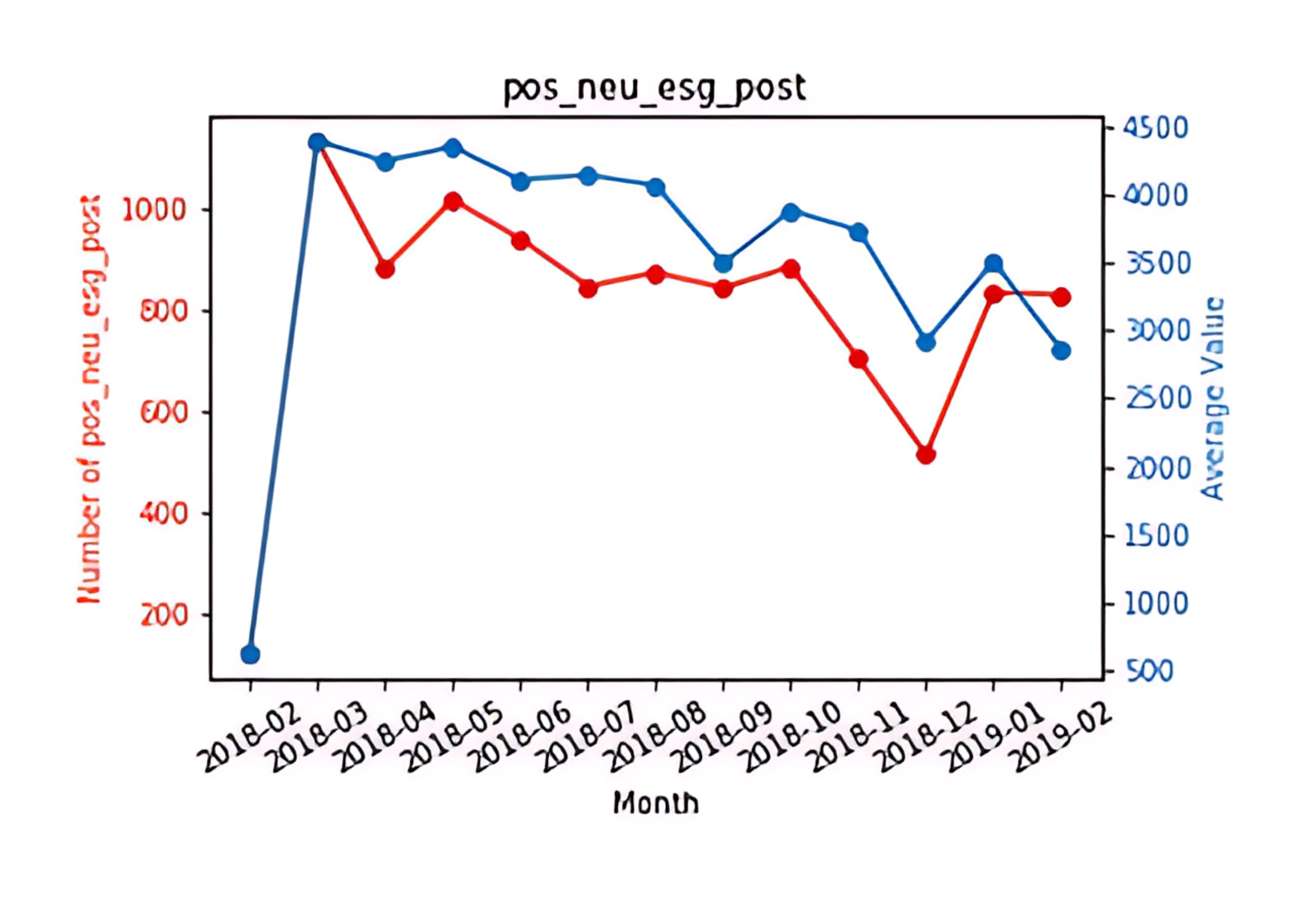

Fig 2. Barclays - correlation between ESG posts and bank valuations

Using the same parameters as for the RBS case, only with posts coming from all sources rather than just news, the correlation was a staggering R2 = 0.92.

Out of the 3 elements of ESG, Governance is the strongest, with the largest number of posts. The direction of causation is easily implied; traders (human or algos) read the news on bank governance which influence sell or buy decisions.

For more findings from the Social Intelligence for Banks report, contact listening247.