Blog Post

The battle of small investors against Wall Street - Part 2

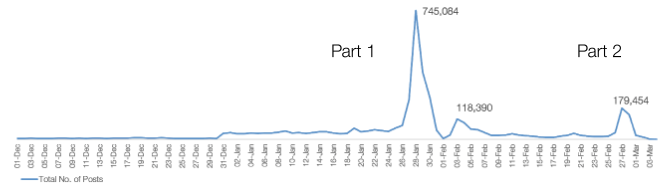

After we published our social intelligence sample report and associated blog post on the GameStop Saga at the beginning of February, things started to cool down on the subject. It was one of those events that got a lot more attention than its fair share, mainly because it captured the imagination of the little guy fighting the establishment, or simply because of social media and other online fora disproportionately amplifying the noise.

The stock price of $GME dropped from a high of US$347.51 on January 27th down to US$40.59 by February 19th; then something peculiar happened!

On Wednesday February 24th it started shooting up again and reached US$91.71 by the end of the day. It continued to rise on Thursday 25th up to US$108.73 and then dropped back to US$101 by COB on Friday 26th. By March 10th it went back up to US$265, and as of March 24th it was US$120.34.

Therefore we felt compelled to publish Part 2.

So, what created the second peak?

Fig 1. Daily number of posts on $GME Dec 1 – Feb 28

With Part 1 covering December and January, we decided to look at the month of February as well. We gathered a total of 1.2 million posts from Twitter, Reddit, blogs, forums, news (editorial), reviews, and videos. Multiple levels of intelligence were added to the gathered posts. Specifically, they were annotated with sentiment, topics and brands using DigitalMR proprietary machine learning models and taxonomies.

One possible explanation for the second stock price hike is the announcement of the GameStop CFO standing down on February 23rd. Of course the fact that Robinhood (the trading & investing platform) removed all trading restrictions earlier in the month was also helpful.

In addition to the changes in the GameStop executive team that may have driven the resurgence, we discovered 3 other noteworthy findings in the February posts: Posts mention the term "diamond hands" and include relevant emojis, indicating that they will hold their stocks regardless of any price fluctuations. Perhaps not everyone, but at least a portion of those involved appear to be determined as ever!

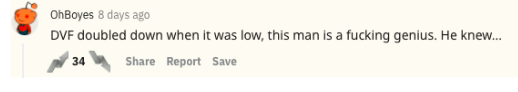

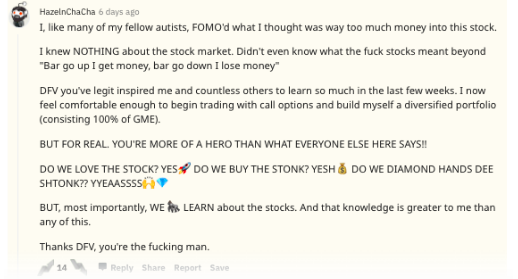

A Reddit user who goes by the nickname "DVF" appears to be an influencer and a role model, with other users mentioning him both on his own posts and on posts by third users.

There is a real sense of community on Reddit, where one user posted about their friend Alex passing away, and many others responded with their support, saying they will hold $GME and other stocks for Alex.

The point of sharing these findings is to demonstrate that with the right social media listening and analytics tool, in a few hours of work, it is possible to discover pertinent information that helps answer critical questions.

Imagine what else could be hidden in the 4 million posts gathered from December to March!

If you have not read the original blog post on GameStop (now called Part 1), you can find it here.

To produce the sample report that informed Part 1 and Part 2 of this blog post, we used our proprietary social intelligence platform - listening247 - to gather over 4 million posts from Twitter, Reddit, blogs, forums, news, reviews, and videos. We even dared to peak into the Dark Web.

Once the data was gathered, we used machine learning models to annotate the relevant posts with sentiment and topics in a quick and efficient way, adding intelligence to the big datasets in a matter of minutes, and the data was visualised on a drill-down dashboard.

The listening247 social intelligence data is recognised by Bloomberg as valid alternative data for the discovery of “new alpha”. It is available to Bloomberg clients on the Enterprise Access Point since December 2020.