Blog Post

The battle of small investors against Wall Street

Everyone loves an underdog story, like the classic David and Goliath, or in this case, GameStop and Melvin Capital. Even if you’re not involved in investing, chances are that you heard about the GameStop story, which started on a Reddit community called Wallstreetbets, went viral and spread like a wildfire.

The story started with Gamestop ($GME) but then many other listed companies became part of the same saga i.e. hedge funds shorted them and groups of retail investors are egging each other on via social media to buy and hold them for as long as it takes to materially hurt the funds involved.

As expected, we were curious about the whole thing, so we decided to have a look on social media and other online sites for learnings that were not obvious and subsequently not in the news. We even dared taking a peek at the Dark Web.

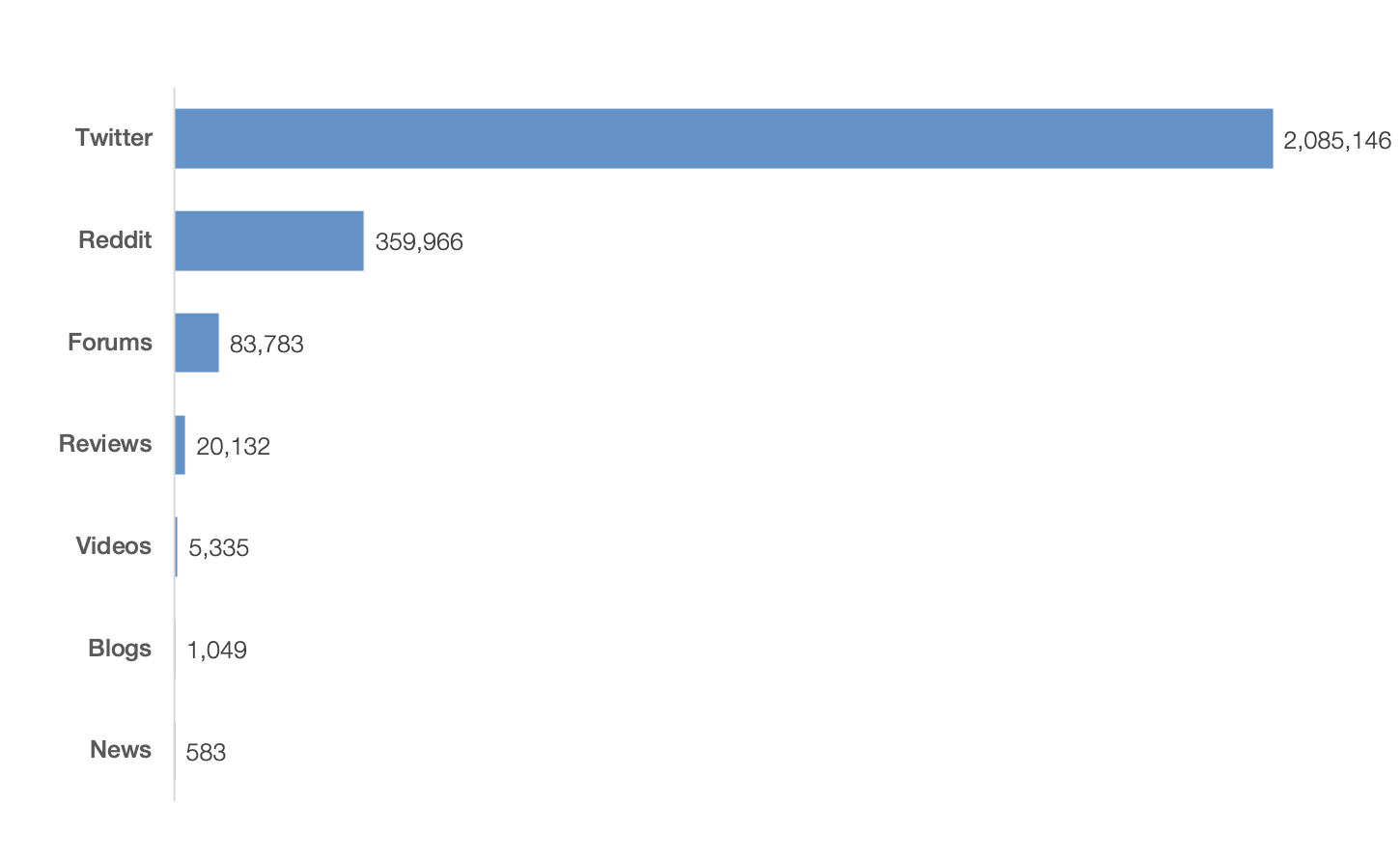

listening247 used its proprietary social listening and analytics platform - to gather 2.5 million posts from December 1st 2020 to January 30th 2021 from Twitter, forums, blogs, news, videos, and reviews, using the following Boolean logic query:

"gamestop" OR "robinhood" OR "melvin capital" OR (("GME" OR "AMC" OR "BB" OR "NOK" OR "EXPR" OR "PLTR”) AND ("stock" OR "stocks" OR "shares" OR "share price" OR "NYSE" OR "nasdaq" OR "wallstreet" OR "trade" OR "trading" OR "short"))

We also gathered the entire Wallstreetbets subReddit from January 23rd to January 30th 2021.

Fig 1.

Once the data was gathered, we used machine learning models to annotate the relevant posts with sentiment and topics in a quick and efficient way, adding intelligence to the big dataset in a matter of minutes.

Up until 10-15 years ago, the only way we could have known what the content of the 2.5 million posts was about was to read each and every one of them. Thankfully, nowadays we have the means to understand big data in an easier way, and so after annotating the data with sentiment and topics, the entire dataset was visualised on a drill-down dashboard.

After a few hours of navigating the data and exploring the online conversations, here are 7 interesting things that came up:

-

1. YOLO. The acronym for “you only live once” appeared nearly 55,000 times - mostly as a verb - by small investors communicating that they were betting all they had on GameStop and some other stocks, in some cases asking for advice or encouraging others to follow suit, and oddly enough, in some cases defying the end goal that’s usually behind an investment decision (i.e. to make a profit).

“At the moment, if I had a spare $50k cash to yolo on something, I'd throw it in GME shares or PLTR shares. PLTR for the long term, GME for the short term. Maybe split $20k GME / $30k PLTR, and once GME hits $150 or higher take my gains and dump them into more PLTR.” - Forums

“I just cleared my debts, i have $500, I want to go YOLO, do i buy GME at the price that its at?” - Reddit

“I bought GME at the top. Don't care about making a profit, fuck it. YOLO.” - Forums

“BRB gonna yolo everything into GME! It can only go up!” - Twitter

-

2. Other companies. Even though we only included keywords or brand names for a handful of companies other than GameStop ($GME), even more companies such as Bed Bath & Beyond ($BBBY), American Airlines ($AAL), AgEagle Aerial Systems ($UAVS), and Pershing Square Tontine Holdings ($PSTH) came up in the data. As it turns out, these are some other stocks that the retail investors are strongly recommending to buy and hold for the same reason as $GME.

Fig 2.

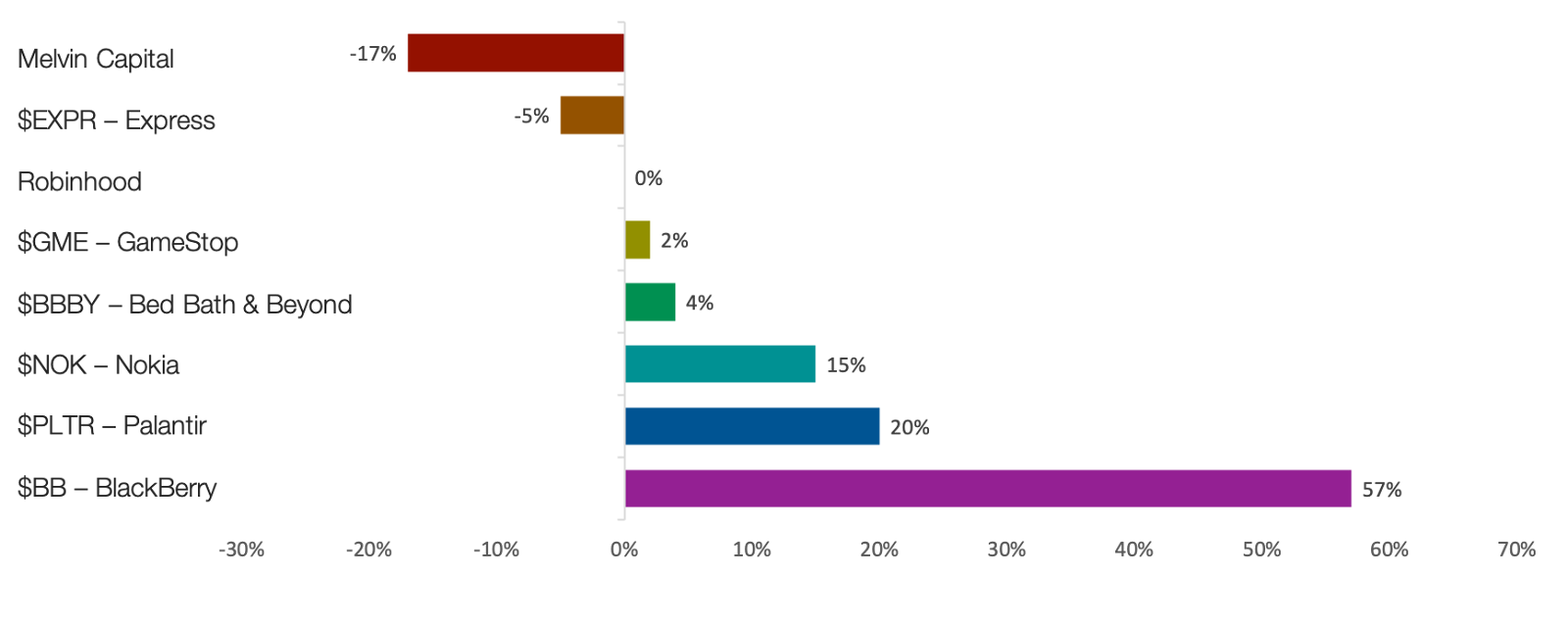

- 3. Sentiment. Net Sentiment Score™ (NSS™) is a great way to rank brands or companies in order to measure brand health and possibly predict how their stock price will fluctuate. It is no surprise that in this case Melvin Capital has the lowest NSS™ at -17%.

Fig 3.

-

4. Elon Musk involvement. Some people - particularly on Twitter - believe that Elon Musk further pushed the $GME story with a tweet, which was perceived as him striking back at Melvin Capital because at some point in the past they had shorted Tesla, and apparently he hates them for that.

“Actually, Elon Musk got involved because once upon a time, Melvin Capital shorted Tesla stock. End of story.” - Twitter

“Elon Musk is shilling GameStop because Melvin Capital shorted Tesla a long time ago and bragged about it.” - Twitter

“Apparently Melvin Capital has been bearish on Tesla for a long time. Elon doesn’t forget. haha” - Forums

“He will be up another 5 Million tomorrow. He should thank Elon for his tweet by ordering 50 Teslas” - Reddit

-

5. Nokia. Over 100,000 posts mention the once popular phone brand, as one of the stocks to keep an eye on and buy or hold so as to replicate the $GME effect. Their stock price peaked on January 27th at 6.55 USD.

“🚀🚀NOKIA (NOK) STOCK | MASSIVE POTENTIAL | ARE YOU BUYING?” - Videos

“Bit late for massive gains on $GME. People are saying NAKD, AMC, NOK, and BB are next” - Twitter

“bought massive amount of NOK, i just hope everyone else is holding it as well. :D” - Reddit

“I was late to GME, I’m waiting on today’s market start dip. I’m in on NOK rn.” - Twitter

-

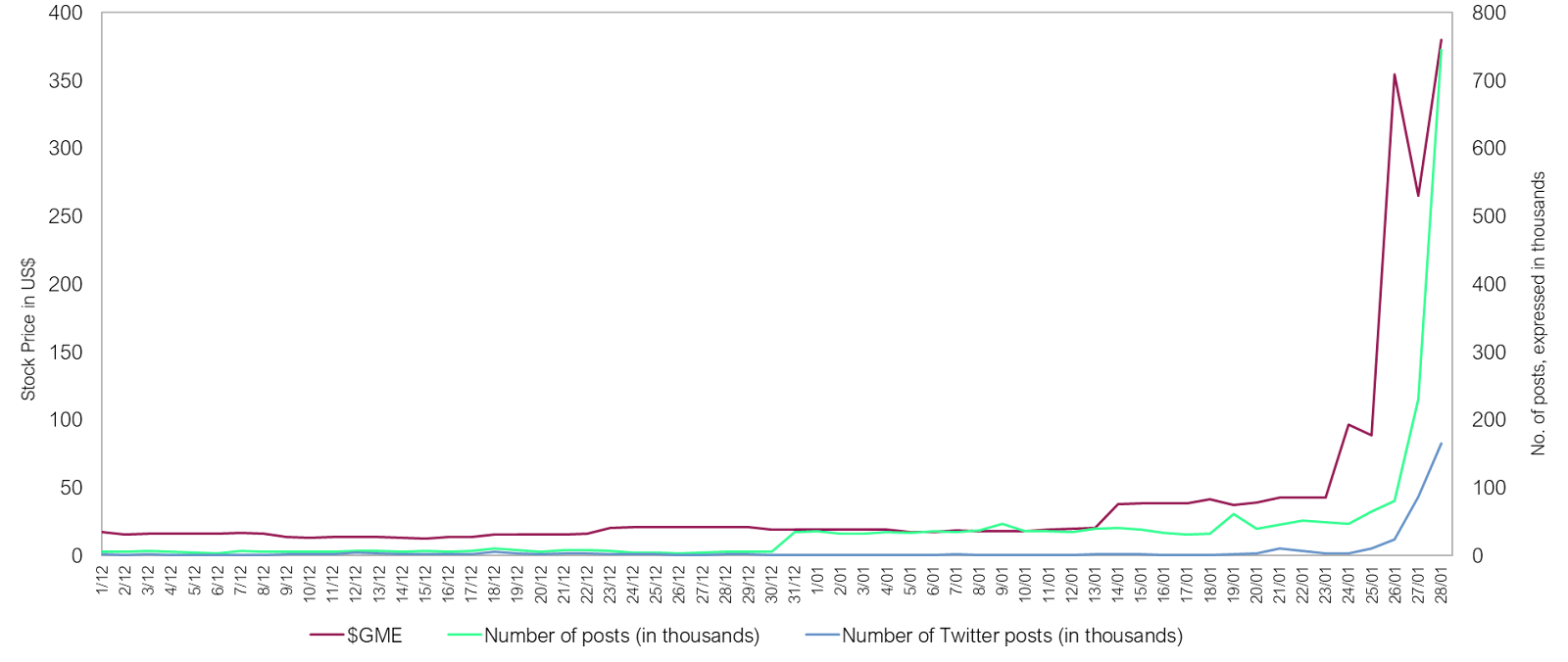

6. Correlation. Very high correlation between online buzz and stock price is observed for companies such as GameStop ($GME), AMC Entertainment ($AMC), and Express Inc. Causation is obvious in this case: online posts by people recommending buying these stocks lead to people actually buying the stocks and thus driving their value sky high.

Fig 4.

-

7. FOMO. Albeit just a small percentage of the entire dataset, it’s interesting that just like YOLO, the acronym for “fear of missing out” comes up in online conversations close to 2,000 times. It seems some of those behind the $GME story belong to the generation where fear of missing out is a significant motivation to buy.

“Am I the only one with FOMO buying GME today? I bought one share yesterday and am getting five when the market opens today...not the biggest loss if it goes badly I guess.” - Forums

“I will feel sad if anyone go broke because they FOMO GME.” - Reddit

“I believe there is definitely a strong element of FOMO with this stock, especially with what we’ve seen in stocks like GME and AMC.” - Forums

“@breakneck_tv I think I hopped into AMC a bit late, but fomo after staring at GameStop the last couple days made it so I couldn’t sit out anymore” - Twitter

That’s it for now in terms of interesting - and in some cases useful - titbits, but in ~2.5 million posts there is bound to be more... Stay tuned!